We’ve studied how current tax is the amount of tax payable to the taxation authorities in the current financial period.

Now we’ll be looking at deferred tax assets and deferred tax liabilities, which are an entity’s way of noting the expected future tax consequences of transactions yet to take place.

The purpose of deferred tax is to apply the accruals basis of accounting for taxes, noting them in the financial statements even though they may not be payable in this reporting period.

Companies pay corporation tax based on their taxable profits.

The taxable profits are multiplied by the tax rate and this calculates the amount payable.

But often the taxable profits are different to the profit before tax figure contained in the financial statements.

Why is this?

Well, it’s down to the fact that the tax authorities use different rules for measuring taxable profits than those used by the company.

For instance, the tax authorities may allow certain capital allowances which reduce the tax payable for purchases of non-current assets.

As a result, the taxation authorities won’t allow depreciation to reduce taxable profits, so depreciation is added back when calculating the taxable profit for the period.

The differences between the taxation authority’s method of accounting and the company’s method of accounting are classified as:

- temporary differences; and

- permanent differences

Tax base

Before we take a look at temporary and permanent differences, you should first get an understanding of what the tax base of an asset or liability will be.

IAS 12 refers to the tax base when calculating deferred tax assets or deferred tax liabilities.

The tax base is the amount attributed to an asset or liability for the purpose of calculating tax.

Another way of thinking about the tax base of an asset or liability is the amount that the item would be shown as an asset or liability in a statement of financial position drafted purely for tax purposes.

It’s the amount that will be deductible for tax purposes against any selling price for an asset.

So it’s the amount that you tell the tax authorities how much an asset cost, or a liability is worth.

For assets, this will usually be the original cost of the asset, which may be indexed linked for the passage of time.

NB: Remember the tax base might be different from the amount shown for the asset or liability in the statement of financial position.

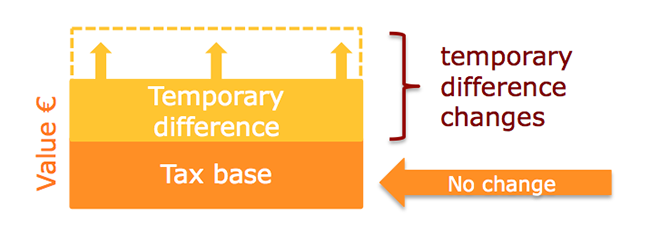

So if we take the amount the asset or liability is contained in the actual SOFP, and deduct the tax base of the asset or liability, we may get a difference.

This is what we call a taxable or deductible temporary difference.

NB: Carrying amount / carrying value is also known as book value

If we multiply this difference by the relevant tax rate, we’ll calculate the deferred tax liability or asset.

So if there’s a taxable temporary difference, there’s a deferred tax liability, and if there’s a deductible temporary difference, there’s a deferred tax asset.

So just a reminder, the provision for deferred tax is based on differences between:

- carrying values/book values in the statement of financial position, and

- the tax base values (aka tax values or tax written-down values).

Temporary Differences

Temporary differences are the differences between the carrying amount of an asset or liability in the financial statements, compared to the tax base of the asset or liability.

Taxable profits are usually different from profits in the financial statements because the Revenue Commissioners and HMRC make their calculations using different rules from the international accountants standards.

For example, most tax authorities do not accept depreciation as an allowable deduction and instead use their own rules or capital allowances to account for the expense.

Tax relief for purchasing assets, in the form of capital allowances, may be given at a different rate to the depreciation charge in the financial statements.

Although the two may be the same over the life of the asset, they will be different in each individual financial year.

So the ‘depreciation’ allowed for tax purposes will be different to the depreciation contained in the financial statements.

This difference is a temporary difference because, over the life of the asset, the total depreciation expenses for the asset in the financial statements and the total tax relief given by the tax authorities will even out.

Revalued Assets

What happens if an asset is revalued under IAS 16 Property Plant and Equipment?

Well, a revaluation of assets may not affect the tax base of the asset, but it may have deferred tax implications if the fair value of the asset changes because a revaluation may change the temporary difference.

Deferred tax should be recognised on the adjustment and should be recognised in other comprehensive income.

The journal entry to do this is:

Permanent Differences

So if temporary differences are those that could give rise to a potential tax charge or refund, if the asset is sold.

Permanent differences are those that are done and dusted, nothing in the future will change them.

They relate to income and expenditure that has been included in the financial statements profit before tax figure, but will never be included in the calculation of taxable profits.

Why not, you may ask?

Well, the item of income or expenditure may relate to something that’s not allowable, or ignored for tax purposes.

Say if you spend money on hosting a big party for your clients, and everyone has a great time. This will be recorded in your financial statements as an expense and reduce your profits.

But when the taxation authorities hear about it, they’ll say no, this isn’t an allowable deduction and you have to add that money back to your taxable profits.

As a result, the company will now pay more tax.

IAS 12 does not define permanent differences, but they do exist, and don’t cause any deferred tax liability or asset.